Banks and Credit Unions are unique.

We apply our financial services industry expertise, experience and innovative thinking to help your organization:

-

Improve customer / member / staff experience

-

Enhance delivery capabilities through quality, efficiency and agility

-

Coordinate and manage strategic prioritization

-

Facilitate and resolve difficult decisions

-

Lead and execute large / complex programs

Key Practice Areas

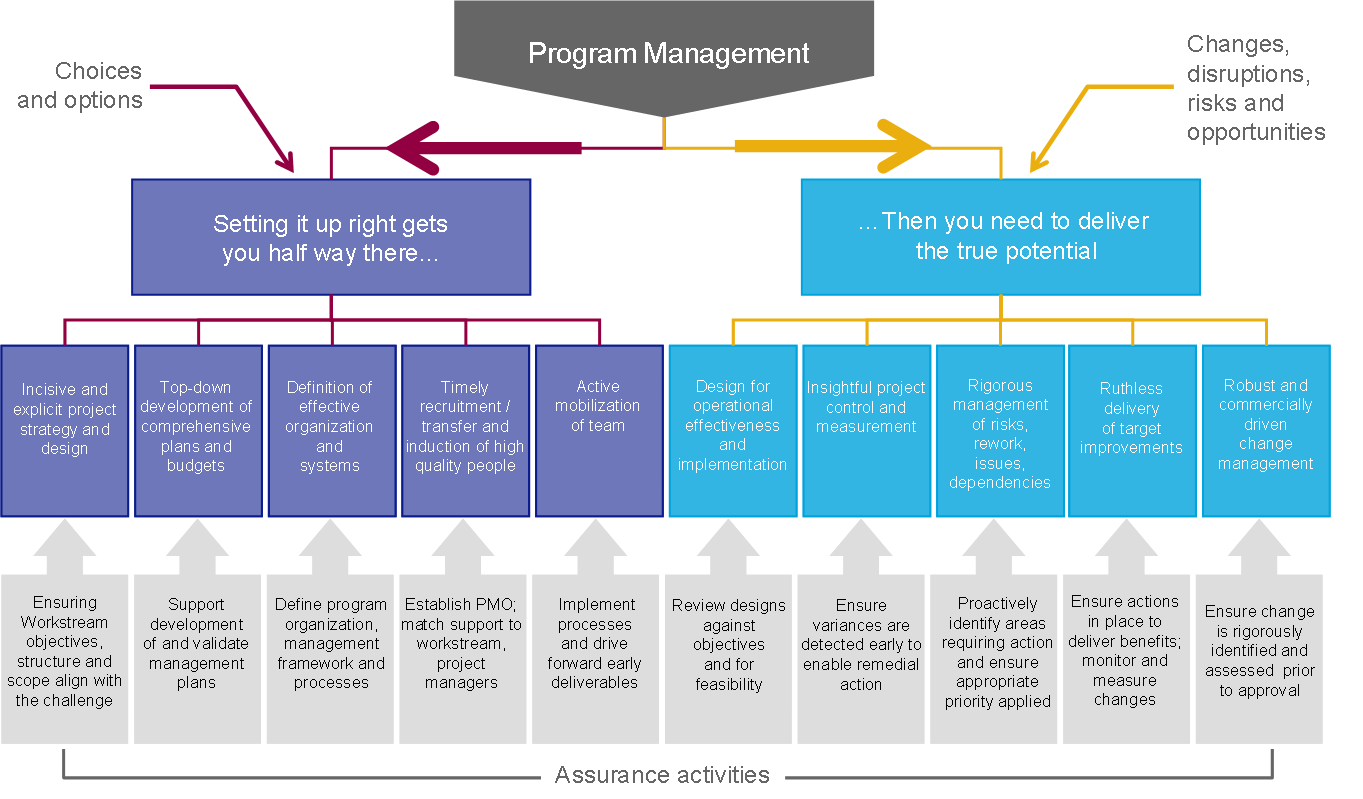

Collaborative Delivery Leadership

Bringing leadership, organization and collaboration for your large / complex consumer and enterprise programs using our adaptive and flexible methods, processes and tools.

Attain target goals and value by:

-

Applying our significant industry experience and expertise

-

Leading programs and projects to successful conclusion

-

Enabling your teams’ continued growth through training, coaching and mentoring

Business & IT Strategy and Prioritization

We assist and guide organizations through your most challenging, complex and important strategic decisions. We leverage our experience and leadership to enable the right outcomes for your unique vision.

Relevant Areas of Expertise:

-

Prioritization and facilitated decisioning

-

Business analysis and subject matter expertise

-

Product / solution evaluation and selection

-

Vendor assessment and negotiation

-

Identification and alignment of factors critical to engagement

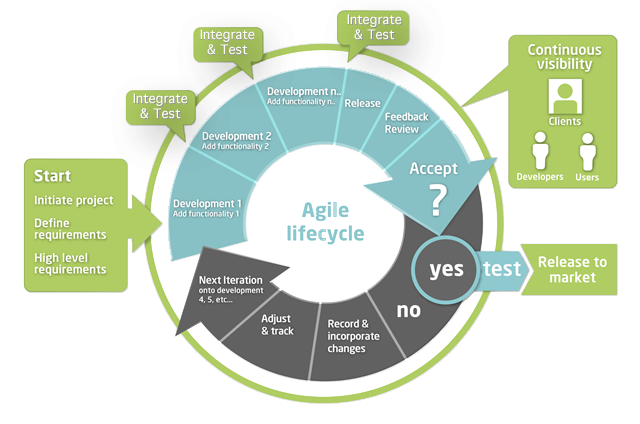

Business Value Focus, Iterative Approach

Applying Agile and Lean methods to your organization is imperative in the increasingly competitive banking-meets-fintech universe. Transformations do not happen overnight... we prefer Agile Evolution

Evolving your business by:

-

Training, coaching and iterative improvements

-

Real-world experience and product / process recommendations

-

Empowering your teams to focus on the things that matter

-

Enabling improvements to reach your customers faster

-

Increasing return on effort

Successes

We connect with our clients as partners

Our mission is to enable our clients and partners to realize loftier goals and improve delivery capabilities and capacity. Hayden Technology helps banks and credit unions leverage and expand the capabilities of their own people and improve insights of data to drive greater business value. We strive to establish long-lasting relationships through personalized and experienced consulting with executives and staff.

Contact Us to discuss how we can help you succeed!We helped First Tech FCU, a top-10 US-based credit union, decide to replace their existing online banking platform. Led decision, selection, management, testing, conversion and production rollout of new platform and integrations with core systems and 3rd-party solutions.

Key Accomplishments:

- Drove key decisions to replace online / mobile banking platform

- Facilitated vendor selection, contract negotiation and relationship management

- Provided program delivery leadership, including executive reporting and tollgate presentations

- Led collaboration efforts with business partners and stakeholders

- Drove transition to production - QA testing, staff training, transition support and member communications

- Produced success metrics and KPIs

- Introduced Agile / Scrum / Lean principles, methods and tools

- Sourced technology resources, including developers, testers, PMs / CSMs

- Leveraged FTFCU data to answer critical business questions

- Led product owner vision / roadmaps

We recommended and engaged with First Tech FCU, a top-10 US-based credit union, to improve and evolve their Agile practice.

Key Accomplishments:

- Provided Scrum training and ongoing mentoring and coaching

- Recommended Agile tools (e.g. Atlassian's Jira and Confluence)

- Assisted with implementation and adoption

Hayden Technology has assisted and consulted with numerous financial institutions on major projects like:

- Rebrand and marketing

- Technology assessment and deployment management

- Legal, data and technology decommission

- Enterprise Resource planning

- Regulatory, risk, legal and compliance

- Card Services and Payments

- Mortgage

- Platform Selection

Leadership Team

Mark Woollen Founder

- Director, Management Consulting

- 20+ years of senior management and technology consulting experience focused in the banking industry.

-

Promotes success through collaboration, partnership and quality execution.

-

Trusted advisor and partner with executives, business partners and project team members.

-

Proven leadership coordinating enterprise software integration, technology design and delivery, complex / critical program implementations.

Recent Posts

Discover the thought leadership, industry articles and interesting reads from our colleagues.

AI Solutions for Small and Mid-sized Banks and Credit Unions

Jul 2, 2024 by Mark Woollen Smaller financial institutions are increasingly using chatbots and virtual assistants to enhance customer service, streamline operational efficiency, and compete with larger banks. These AI tools offer 24/7 support, manage routine inquiries, automate transactions, provide proactive communication, and ensure security and compliance, enabling personalized and cost-effective customer engagement.

read more...Artificial Intelligence Big data Credit Unions Digital Banking Fintech

How AI is Transforming the Financial Industry

by Mark Woollen Artificial Intelligence (AI) has been making waves across various industries, and the financial sector is no exception. AI technologies, such as machine learning (ML), natural language processing (NLP), and robotic … Continue reading “How AI is Transforming the Financial Industry”

read more...