Banks and Credit Unions are unique.

We apply our financial services industry expertise, experience and innovative thinking to help your organization:

-

Improve customer / member / staff experience

-

Enhance delivery capabilities through quality, efficiency and agility

-

Coordinate and manage strategic prioritization

-

Facilitate and resolve difficult decisions

-

Lead and execute large / complex programs

Key Practice Areas

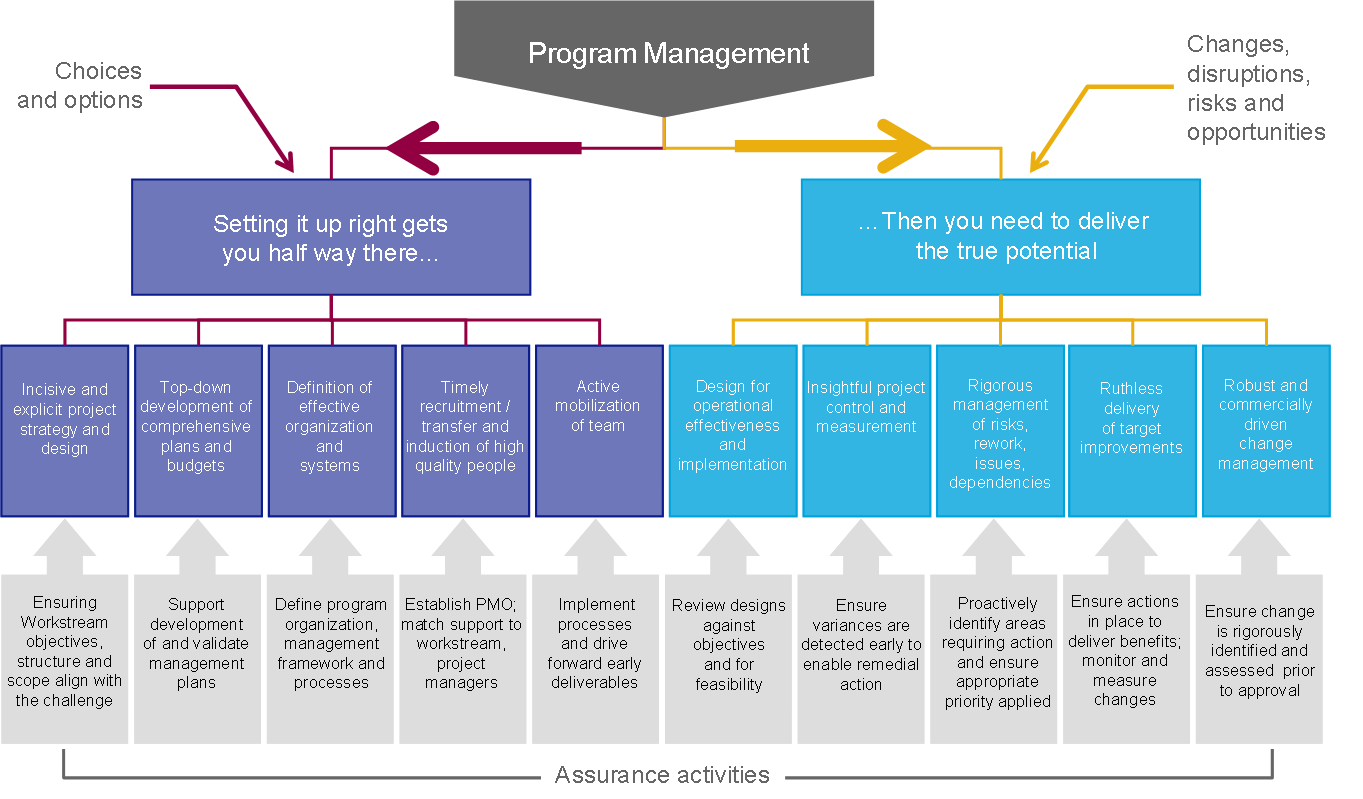

Collaborative Delivery Leadership

Bringing leadership, organization and collaboration for your large / complex consumer and enterprise programs using our adaptive and flexible methods, processes and tools.

Attain target goals and value by:

-

Applying our significant industry experience and expertise

-

Leading programs and projects to successful conclusion

-

Enabling your teams’ continued growth through training, coaching and mentoring

Business & IT Strategy and Prioritization

We assist and guide organizations through your most challenging, complex and important strategic decisions. We leverage our experience and leadership to enable the right outcomes for your unique vision.

Relevant Areas of Expertise:

-

Prioritization and facilitated decisioning

-

Business analysis and subject matter expertise

-

Product / solution evaluation and selection

-

Vendor assessment and negotiation

-

Identification and alignment of factors critical to engagement

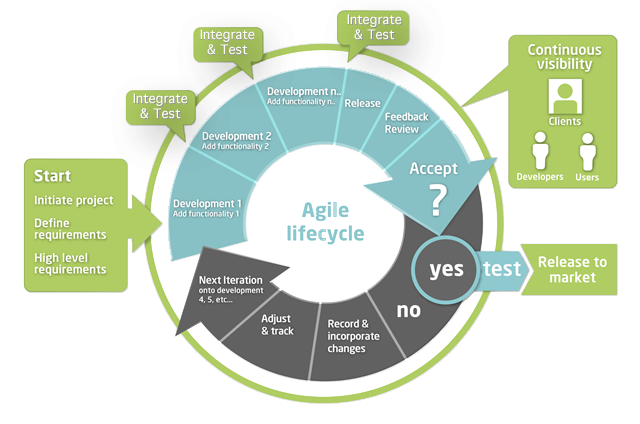

Business Value Focus, Iterative Approach

Applying Agile and Lean methods to your organization is imperative in the increasingly competitive banking-meets-fintech universe. Transformations do not happen overnight... we prefer Agile Evolution

Evolving your business by:

-

Training, coaching and iterative improvements

-

Real-world experience and product / process recommendations

-

Empowering your teams to focus on the things that matter

-

Enabling improvements to reach your customers faster

-

Increasing return on effort

Successes

We connect with our clients as partners

Our mission is to enable our clients and partners to realize loftier goals and improve delivery capabilities and capacity. Hayden Technology helps banks and credit unions leverage and expand the capabilities of their own people and improve insights of data to drive greater business value. We strive to establish long-lasting relationships through personalized and experienced consulting with executives and staff.

Contact Us to discuss how we can help you succeed!We helped First Tech FCU, a top-10 US-based credit union, decide to replace their existing online banking platform. Led decision, selection, management, testing, conversion and production rollout of new platform and integrations with core systems and 3rd-party solutions.

Key Accomplishments:

- Drove key decisions to replace online / mobile banking platform

- Facilitated vendor selection, contract negotiation and relationship management

- Provided program delivery leadership, including executive reporting and tollgate presentations

- Led collaboration efforts with business partners and stakeholders

- Drove transition to production - QA testing, staff training, transition support and member communications

- Produced success metrics and KPIs

- Introduced Agile / Scrum / Lean principles, methods and tools

- Sourced technology resources, including developers, testers, PMs / CSMs

- Leveraged FTFCU data to answer critical business questions

- Led product owner vision / roadmaps

We recommended and engaged with First Tech FCU, a top-10 US-based credit union, to improve and evolve their Agile practice.

Key Accomplishments:

- Provided Scrum training and ongoing mentoring and coaching

- Recommended Agile tools (e.g. Atlassian's Jira and Confluence)

- Assisted with implementation and adoption

Hayden Technology has assisted and consulted with numerous financial institutions on major projects like:

- Rebrand and marketing

- Technology assessment and deployment management

- Legal, data and technology decommission

- Enterprise Resource planning

- Regulatory, risk, legal and compliance

- Card Services and Payments

- Mortgage

- Platform Selection

Leadership Team

Mark Woollen Founder

- Director, Management Consulting

- 20+ years of senior management and technology consulting experience focused in the banking industry.

-

Promotes success through collaboration, partnership and quality execution.

-

Trusted advisor and partner with executives, business partners and project team members.

-

Proven leadership coordinating enterprise software integration, technology design and delivery, complex / critical program implementations.

Recent Posts

Discover the thought leadership, industry articles and interesting reads from our colleagues.

Exceleration: Power Apps Get Sharepoint Data using Power Automate

I have recently thought about caching in Powerapps using collections. Cached data can help with performance. I’ve been investigating the use of SharePoint REST APIs in place of Connectors to SharePoint… 1. you can avoid challenges with delegation, 2. you can leverage pagination, 3. you can cache SP JSON responses. Caching, to me, implies that you want to check the cache for a valid entry that both exists in the cache and has not yet expired. 3 phase logic follows:

1. If the entry is valid (exists and has not expired), then just simply return the cached data from the cache/collection.

2. If the entry exists in the collection, but has expired (e.g. the data hasn’t been refreshed in x number of seconds, then get a fresh copy of the data and update (patch) the invalid entry.

3. If there is no entry in the cache, then get a fresh copy of the data and save (patch) in the cache (collection)

Coalesce helps to facilitate this. Coalesce will essentially try an option and if that option is invalid, it will try the next option.

I have created a “Power Automate” flow called “HT – Generic SP Call” that makes a generic “GET” call to SharePoint and returns the resulting JSON (even if the JSON results contain a list… I can store this as a Single entry in my cache and set a timestamp. This flow does not require any premium connectors or special magic.

- In the first step, define two inputs: in_baseurl and in_restcall.

- In the second step, send in_baseurl to Site Address and in_restcall to URI. Also add Header “Accept” = “application/json;odata=nometadata”. I also rename this step = “HTTP _Request”.

- In the third step, return “data” with expression “string(body(‘HTTP_Request’))”

Now, you can add this flow to Powerapps using the “Power Automate” configuration button.

OK, about the cache (collection) in Powerapps. A collection called coll_httprequests with columns “httprequest”, “httpresponse”, and “timestamp” will be created by the component and available to your Powerapps. My cached item in this case will expire after 145 seconds.

Create an invisible component, add a property named “get” of type “Action” that returns Text. Add 3 input parameters: in_baseurl (type text), in_request_uri (type text), and in_expiry (type number). Place the following in the result.

If(LookUp(Sort(coll_httprequests,timestamp,SortOrder.Ascending),httprequest=in_request_uri).timestamp > (Now() - in_expiry/24/60/60), LookUp(Sort(coll_httprequests,timestamp,SortOrder.Ascending),httprequest=in_request_uri), Patch(coll_httprequests, Coalesce( LookUp(Sort(coll_httprequests,timestamp,SortOrder.Ascending),httprequest=in_request_uri), Defaults(coll_httprequests)), {httprequest:in_request_uri,httpresponse:'HT-GenericSPCall'.Run(in_baseurl,in_request_uri).data,timestamp:Now()} )).httpresponse

Now, add this component to your Powerapps. And now you can call Component_1.get(“https://_____.sharepoint.com/sites/____”, “_api/web/lists”,30). And then parse the results into a Table. This is a little tricky… you need to know the structure of the response. See https://learn.microsoft.com/en-us/sharepoint/dev/sp-add-ins/working-with-lists-and-list-items-with-rest. Set(var_getit7,

SPConnect.get(var_baseurl,"_api/web/lists",60)); ClearCollect(coll_splists, DropColumns(AddColumns( Table(ParseJSON(var_getit7).value), "Title", Text(Value.Title), "Id", Text(Value.Id), "Description", Text(Value.Description), "DecodeURL", Text(Value.ParentWebPath.DecodedUrl), "ImageURL", Text(Value.ImageUrl) ),"Value"));

I provided some “write up” on how to do the Power Flow HTTP call to SharePoint in a “non-premium” way. https://sharepoint.stackexchange.com/questions/282308/how-to-send-json-data-to-power-apps-from-power-automate-ms-flow

Cheers!

Exceleration: Import JIRA data into Excel using Power Query and JIRA REST API

What if you could create reports and inspect data from JIRA using Excel easily, efficiently and intelligently? JIRA by Atlassian may be the most popular Agile project management tool embraced by Scrum Masters, Product Owners, developers, testers and the organizations that depend on them. Excel by Microsoft is undoubtedly the most widely used spreadsheet (data analysis and reporting) tool used by leaders, communicators and basically anyone that uses a computer. What if you could have your Jira cake and eat it with Excel, too?

JIRA provides a full set of REST APIs giving programmable access to create, read, update and delete (CRUD) the data maintained behind-the-scenes. Microsoft Excel (since 2016) provides Power Query capabilities that enable “easy button” refresh capability within your worksheets, pivot tables, charts and dashboards. Wait… what? Here, I’ll show you. Follow these steps

Get a Jira API Token

Go to Security API Tokens. To find this the normal way, click top-right icon and select “Manage Account”. Then, go to Security Tab, scroll down and select Create and Manage API Tokens. Click “Create a new key”, enter name then be sure to copy/save your Key in a safe place (for security reasons, it will only be visible this one time)… You’ll use this as your password in Excel Power Query to connect to Jira APIs.

Search for Jira items using Jira Query Language (JQL)

Jira Query Language allows you to filter, sort and retrieve Jira data. Click on “Issues” in your project or menu item “Filters” and “Search for all issues.” To search for targeted issues, you can modify the filter on Jira fields like Project, Type, Status, Assignee and more.

Retrieve Jira data from REST APIs

Many cloud applications transport data between data store and user interface via REST APIs (Representational State Transfer Application Programming Interface). Often, these APIs are made available for external access. We will use the APIs and the resulting data to feed into Excel. First, let’s try out the REST API. You can do this right in your browser. You’ll need:

-

- Jira Base URL (see section above)

- REST API (see JIRA Cloud REST API documentation online)… the request we’re looking for is Issue Search (/rest/api/3/search)

- JQL Query (notice the URL from the Search for Jira Items above (specifically jql=project%20in%20(HTS)… you could also take the JQL string (with spaces) and encode a URL friendly string using https://www.urlencoder.org/… I find it easier to just grab it from the browser URL address.

Putting it all together… [Jira Base URL] + [REST API] + “?” + [JQL Query] and paste into a browser window… you get a bunch of data in JSON format. JavaScript Object Notation (JSON), is an open data interchange format that is both human and machine-readable.

Create a Power Query (available in Excel since 2016 and Microsoft’s Power Query M Formula Language

OK… now, we want to pull the all this together and connect Excel to the JIRA APIs using Power Query. Go to Data –> Get Data –> From Other Sources –> From Web

Excel Power Query Get Data from JIRA

Copy in the full used above to retrieve JSON data from JIRA

You may (should) be prompted to enter your Jira credentials. Generally, you’ll only be prompted once for this as Excel will store your credentials / settings for each unique website in the OS for future workbook connections… OK, pay attention here, there are numerous authentication options available.. you want to use “Basic” Authentication… use your Jira username (your email address in Jira Cloud) and use the Jira Access Token created in the step above.

Once you are successfully authenticated… the JSON data will be interpreted by Microsoft Power Query and allow you to make selections (or use M Query in advanced editor)

Pretty cool.